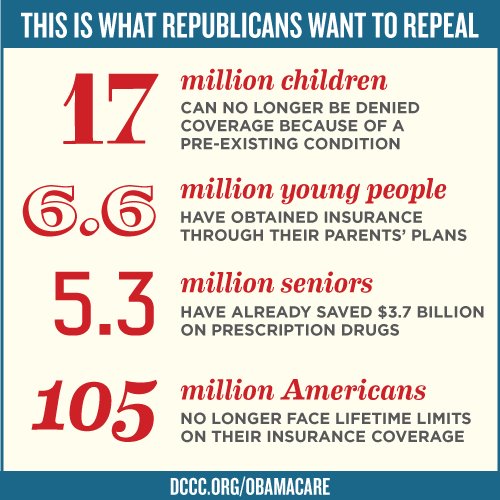

I’d posted, shared, a short graphic about the Affordable Care Act. It contained examples of people who benefit from the law. I usually post items like this on my blog page in Facebook, rather than my personal page, but this one needed to reach a wider audience – or so I thought.

An acquaintance from my undergraduate days – dare I call him a friend? – commented “Single Entry Accounting…”

Background: This acquaintance was someone I liked and respected. He was and I’m sure still is a very intelligent and multi-talented man. He fell into the category of people we called book smart, but not people smart. Thirty years ago on our small college campus, he was known as very, very intelligent, but not very wise.

So this slam, and yes it’s a slam, still hurt. It stung more than a little to hear this former friend, now a business owner in the financial field, thought I had posted something misleading. .

I have strong feelings about the Affordable Care Act. Biased? Absolutely, I am. I can go down the posted list and find family members and friends affected in each and every category.

Pre-existing conditions:

- Congenital blindness

- Autism

- Anxiety

- Depression

- Asthma

- Tension headaches

- Cardiac conditions

- Let’s not consider being female a pre-existing condition, at least for now.

Retain coverage through parents’ plans:

- My oldest is 25. She lives independently, and is starting a new job in her field even as you read this. She’s a college graduate and a young woman with a strong work ethic. None of her employers thus far have had health insurance available for her.

- My youngest is 20. Blind since birth, on the autism spectrum, intelligent, creative, talented, outgoing and friendly. He might qualify for Medical Assistance or he might not. If he doesn’t, he’ll need to remain on my policy until he finds a full time position that offers benefits.

Seniors: I’m not there yet, but my day will come. In the meantime, this affects:

- mother

- stepfather

- mother-in-law

- father-in-law

- many extended family, including several with “pre-existing” conditions that need ongoing treatment

Lifetime limits: what if you, your family, or your friends have —

- cancer

- pre-cancerous conditions

- MS

- heart disease

- asthma

- clinical depression

- vision impairment

- hearing impairment

- high blood pressure

- severe allergies

- autoimmune diseases

- Have I left anyone out? Family? Friends? Anyone?

Now that I’ve shared my reasoning and rationale for sharing the graphic in the first place, I’ll address the criticism.

Hey, old “friend,” I know you’re in a different position professionally than I am. I know you’re a successful business leader in the private sector, and you look at taxes from that angle. Since you’re in the financial field, I respect your knowledge of standard accounting practices. When I posted the chart, I made no secret of my bias. I did not claim to share both sides of the issue, including the overall cost of implementing the law. Your comment was an obvious put-down. In fact, you may have hoped that I didn’t know the meaning of the term “single entry accounting” and meant to imply my ignorance.

Old “friend,” I hope you always have the health coverage that your family needs and you never have to worry about being dropped or excluded. If you or your family need care, I hope you have no trouble finding medical specialists and paying their fees. I wish you and yours good health now and as you age. As for the Facebook bit, I don’t plan to unfriend you. The divisiveness in our nation is severe and widespread already, and I’d rather not add more. Indeed, you may have already taken me off your news feed or friends list. If you don’t want to read my updates any more, I’ll understand.

Sincerely, your old college pal, Daisy

In conclusion, a Note to Self: Attend the messaging workshop at the local OFA office. Learn the best ways to make a point. Thicken skin and prepare for more attacks. Don’t stop believing, though. Health care for all is far too important to lose.

You are absolutely. Health care is waaaay too important to lose.

The “friend” who made the snarky accounting comment was not thinking, or he’s totally unaware of real life as the rest of us know it. Today I paid $6,000 for hearing aids. That’s nearly an entire year of my social security payments.

It’s an investment, but it’s expensive to buy decent hearing aids. Despite the fact that they’ll last potentially ten years, the purchase still requires a substantial outlay of funds.

I mean, you are absolutely right! I left out a word in my haste to comment. . .